Adrián Ravier: «Milei’s Monetary Plan and Disinflation»

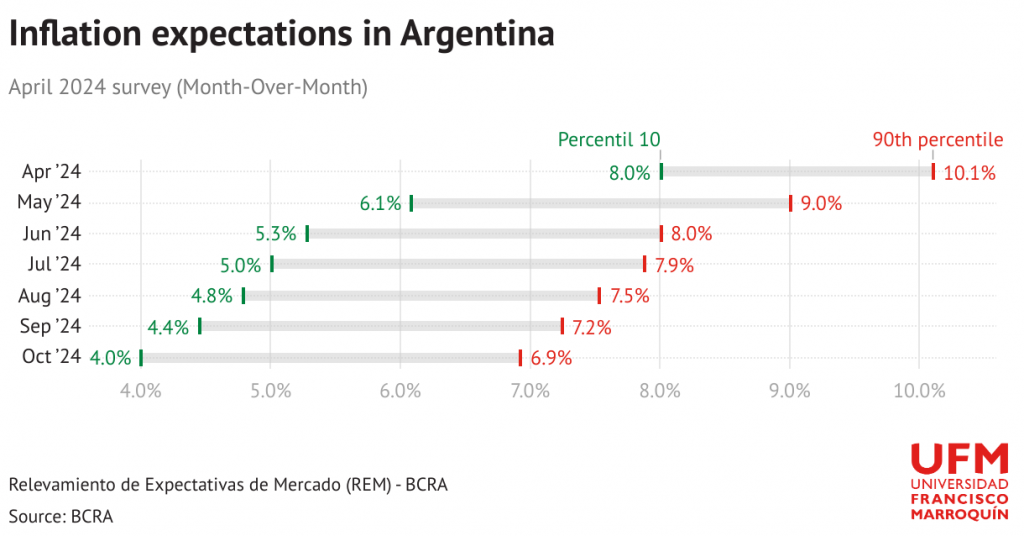

The Consumer Price Index (CPI) went up by 211.4% in 2023, with its monthly increase jumping from 6% in January to 25.5% in December 2023. Given this upward trend, Argentina was clearly heading towards hyperinflation. Javier Milei, during his campaign, quoted Milton Friedman by pointing out that the only cause of inflation is monetary, which led the government to implement a monetary disinflation plan. Although this plan would maintain the CPI at similar accumulated levels for 2024, the monthly figures will see a marked decline, starting with 20% in January but dropping to a single digit per month as soon as June this year.

Is it feasible to think of a continuous decrease in the inflation rate in 2024 through contractionary monetary policy, also acknowledging suppressed inflation inherited from the past?

The Starting Point

The Central Bank’s balance sheet includes three fundamental items to fathom and understand the intentions of the Caputo-Milei monetary reform:

- Base money ceiling:

The monetary base, which as of February 20 amounted to $10.3 trillion pesos, the same amount as on December 10. We suggest the government imposed an implicit base money ceiling; - Interest-bearing liabilities:

The interest-bearing liabilities, formerly known as Lebac or Leliq, now reverse repos, which as of that date totaled 27.9 trillion, compared to 26.8 trillion pesos on December 10; and - International reserves:

On the asset side, the international reserves, which on February 20 amounted to $27.1 billion dollars, compared to $21.2 billion at the start of the Milei administration.

If we follow the logic of Milton Friedman, which President Javier Milei has repeated ad nauseam, the only explanation for the current levels of inflation is the monetary imbalance. That is why fiscal adjustments act as an “anchor” in this economic plan, because balancing the budget allows stopping the monetization of the government spending deficit, which would imply keeping the monetary base constant moving forward.

Inconveniences

The above mentioned, however, has two drawbacks:

- The volume of reverse repos, which could potentially generate future issuance and inflation. If fixed-term deposits are not renewed, banks will have to hand over pesos to depositors, and this could imply an expansion of the monetary base. However, the central bank can rightfully boast having mitigated this risk, even with a significant reduction in the interest rate on these liabilities, from 130% to 100% per annum. A projected inflation rate of around 200% per year for 2024 implies that these liabilities are rapidly diluting.

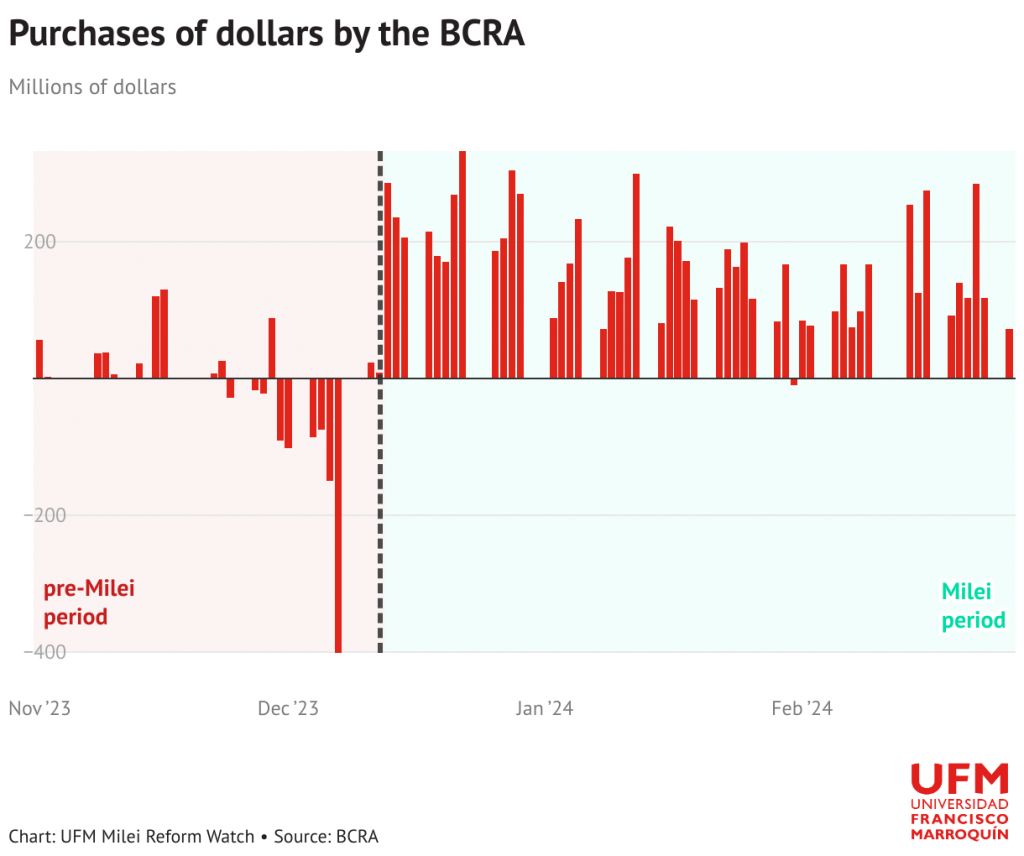

- The purchases of foreign currency to build up international reserves. It should be noted, however, that it is mostly the Treasury that is financing these reserve purchases through debt issuance in pesos, to then hand them over to the central bank. In other words, what we are seeing is a reversal of the process of debt accumulation by the Central Government within the central bank, while it takes responsibility for its past mismanagement (under previous governments).

The Monetary Plan and Inflation Expectations

The Central Bank’s monetary plan for 2024 aims to contain the growth of the monetary base while diluting interest-bearing liabilities and adding new international reserves. This is a preliminary step for any stabilization plan or even for dollarizing the Argentine economy.

The plan, after the first 60 days, seems to show a resounding success, which allows for the deactivation of hyperinflation expectations and immediately shows a decrease in the monthly inflation rate measured by CPI (25.5% in December 2023, 20.6% in January 2024, and an estimated 18% for February 2024).

In this regard, it is worth mentioning the Market Expectations Survey (REM) that the Central Bank issues on a monthly basis in collaboration with private consultants.

Inflation expectations in Argentina

Currently, the latest report of January reveals that the CPI increase of 20.6% was even lower than the average projected by private consultants (who forecasted 21.9%). The February REM will likely show even more favorable expectations than those observable in the chart, if we include the new information from the fiscal situation of January and the accumulation of international reserves.

The reserves are growing due to their daily purchases. We even estimate that the reserve accumulation target for 2024 with the IMF could be largely exceeded – currently, monthly purchases average around USD 2.5 billion, in addition to the IMF loan, while waiting for the harvest results around mid-year.

Here, the Bopreal played a central role, a bond issued by the BCRA, since its successful placements in January and February allow importers, through sales in the secondary market, to obtain foreign currency to settle debts, while it absorbed monetary base and enabled the partial purchase of reserves.

When the Decline in Inflation Is Confirmed, the Demand for Money Will Recover

This decline in the monthly inflation rate, even in the second quarter of 2024, will shape stabilization expectations, which will allow an increase in the demand for money (which behaves inversely to the inflation rate) to absorb part of the BCRA’s liabilities.

Let us remind that the Argentine economy is demonetized, considering that under normal conditions it operates with 15% of M2 (monetary base plus demand deposits) over GDP and/or 9% of monetary base over GDP, while today it barely accounts for 7.5% and 3% of GDP, respectively.

The increase in the demand for money that accompanies the stabilization process also allows the BCRA to reduce the rate it pays on its liabilities, which implies a partial absorption of these money surpluses in a process of monetary normalization.

The Micro-Devaluations of 2% Monthly

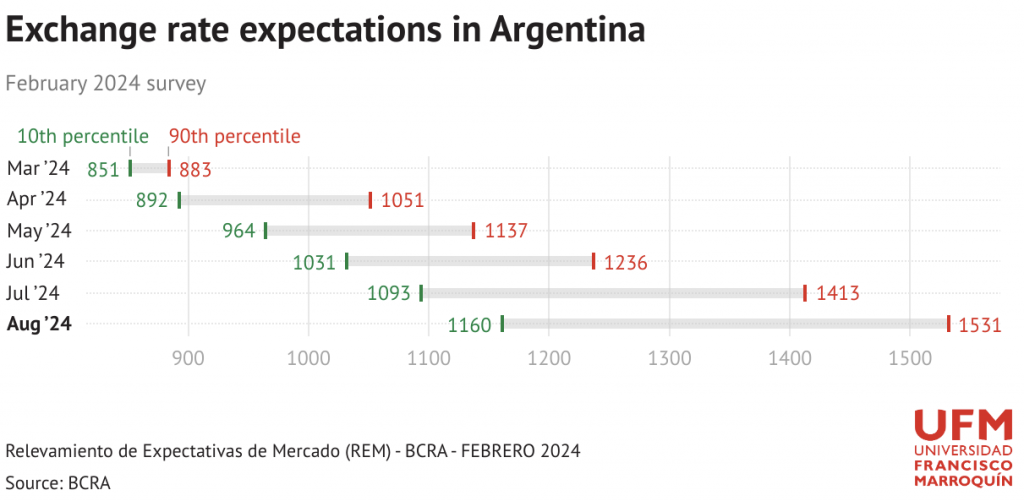

Numerous analysts point out that given the inflation rate that will accumulate between December 2023 and February 2024, and similarly in the following months, the government will have to recognize a new devaluation to avoid falling behind on the exchange rate again. However, given the magnitude of the initial devaluation and the fear that a devaluation would imply a price escalation and an impact on the demand for money, the government has insisted that there will be no devaluation.

To the fiscal anchor and the monetary plan we describe here, the exchange rate anchor is added. In this regard, the market begins to offer better expectations about the possibility that Minister Caputo can maintain the crawling peg at around 2%. Even so, the projection by private consultants in the REM assumes an exchange rate by December 2024 of 1700 pesos, which implies a higher rate of devaluation of around 7-8%. Will these expectations correct over time?

Repressed Inflation

From what has been said, it is observed that Argentina’s inflation problem cannot be resolved solely with an orthodox fiscal plan that achieves fiscal balance, and thus stops monetizing the government deficit. This is because the accumulation of passive repos represents future inflation, as it is understood that they can become a source of increase of the monetary base.

Even if the Central Bank contains this source of inflation and also avoids a new devaluation, Argentina still has to resolve other issues that could cause inflation.

This concerns price controls or the “careful pricing” program that added to the delay in some price changes such as of fuel as well as government service tariffs (for instance, public transport) that could experience significant increases in March, while trying to remove subsidies to lower public spending. This particular point deserves a separate debate.

Some analysts maintain that significant price increases are not inflationary because, although they force consumers to allocate more money to these goods or services in the basket, doing so will force them to reduce their spending on others. While the CPI may show the impact on the consumption of these goods or services, it is also true that there would be no impact in the aggregate.

Source: https://milei.ufm.edu/en/2024/monetary-plan-disinflation/

Te puede interesar:

- « Anterior

- 1

- …

- 3

- 4

- 5

- 6

- 7

- …

- 16

- Siguiente »